Version : 2.1

Make sure your AutoCount Revision Rev: 35 or above

Remark :

Setting Default Tax code from 6% to 8% after March 2024

Method 1 :

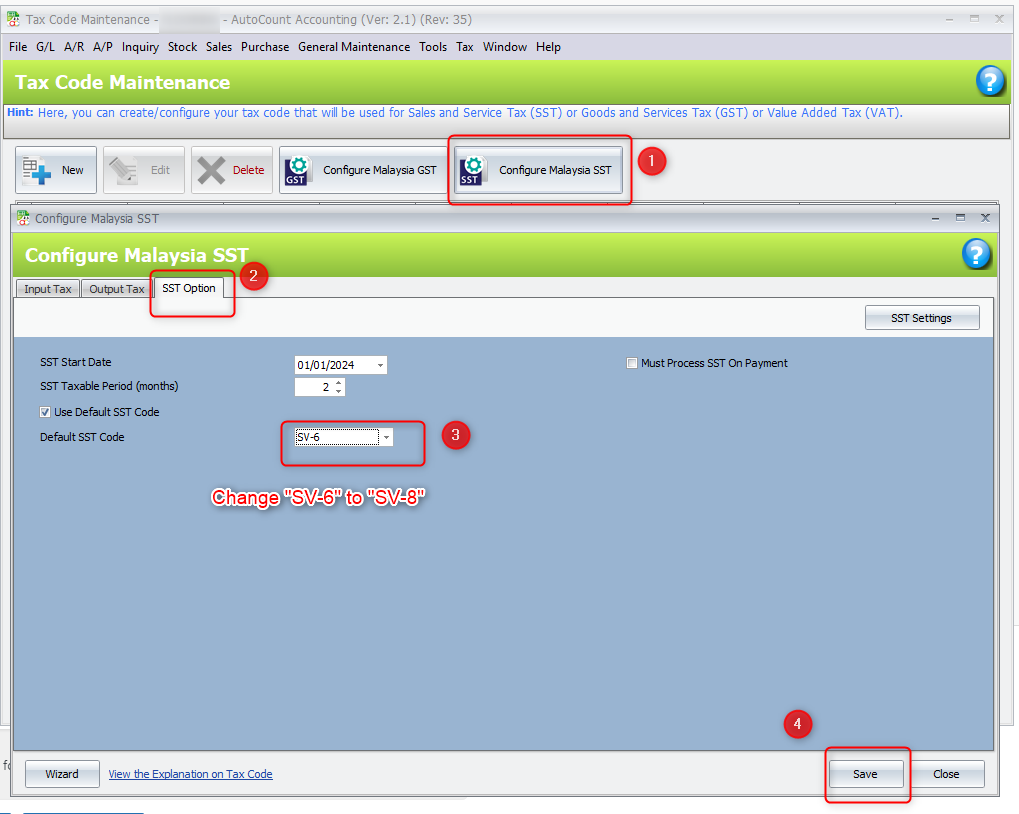

Go to Tax > Tax Code Maintenance > Configure Malaysia SST

If Checkbox “Use Default SST Code” is Tick

Default SST Code change from “SV-6” to “SV-8”

** If you are using this Method default tax code no need setting Method 2 or Method 3 step**

Method 2 :

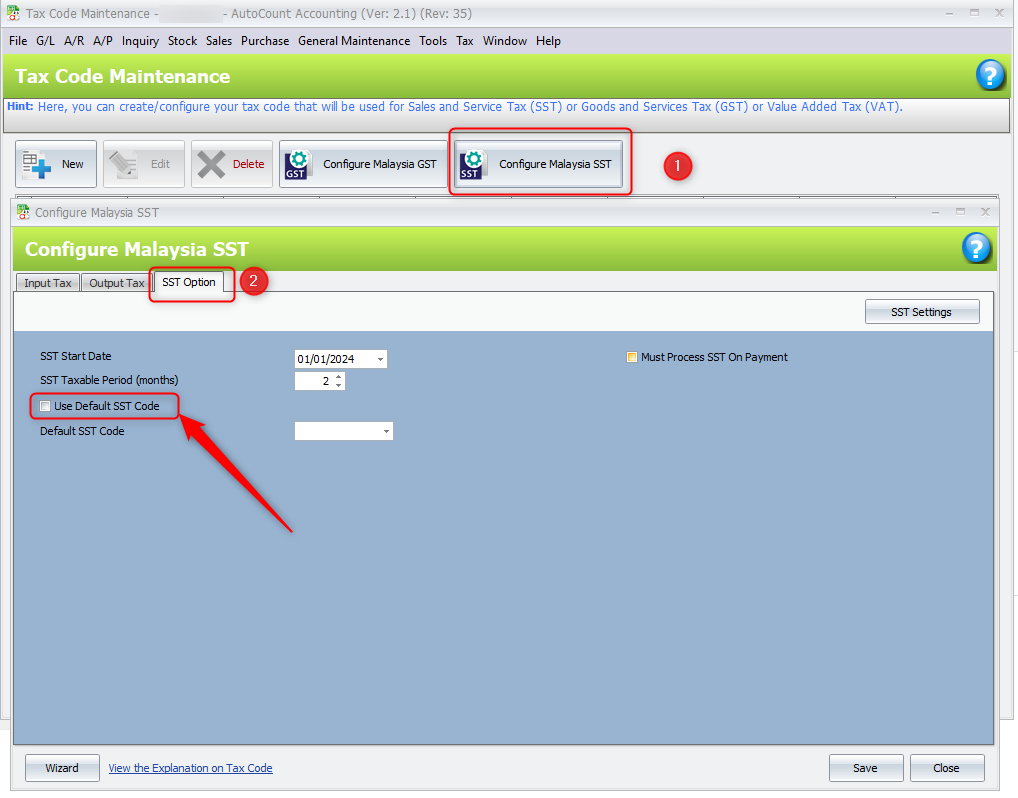

- Go to Tax > Tax Code Maintenance > Configure Malaysia SST

If Checkbox “Use Default SST Code” is Untick , you are using Method 2 default SST Tax code

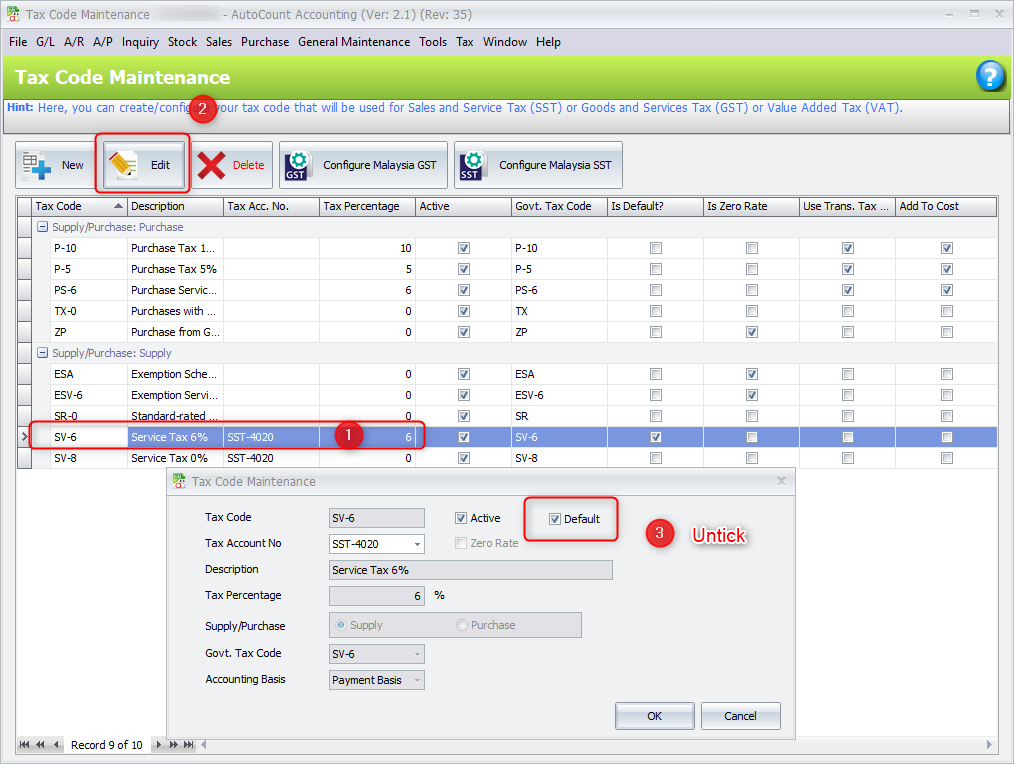

2. Go to Tax > Tax Code Maintenance

3. Select Tax code “SV-6” and Edit

Untick Checkbox “Default“

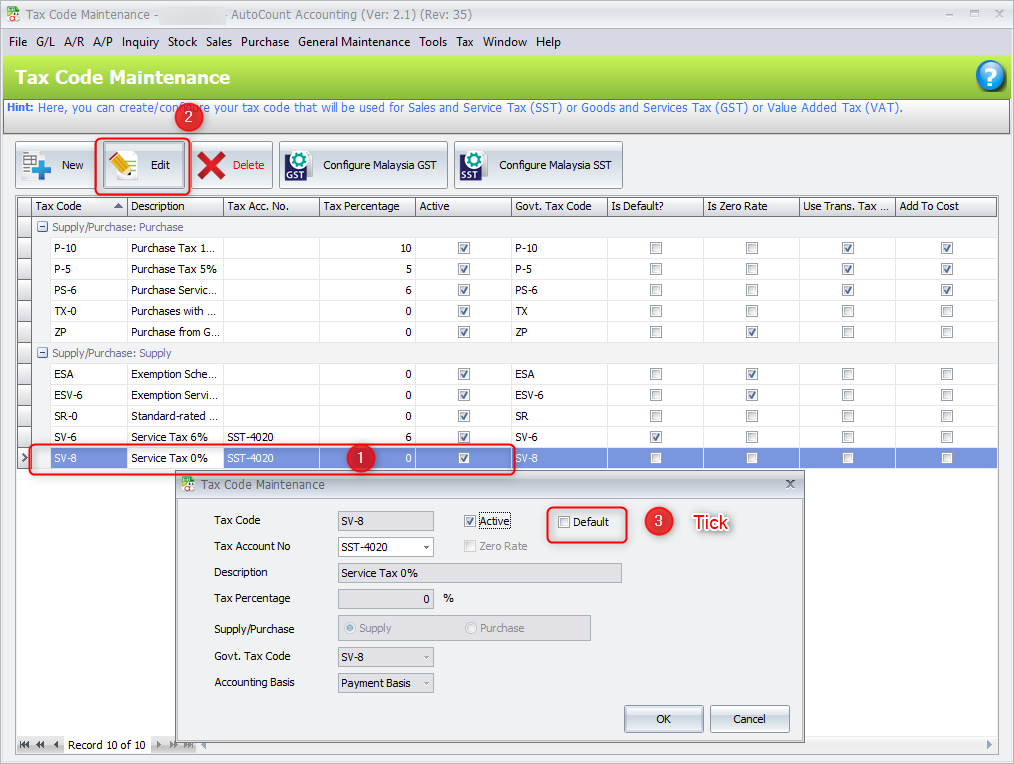

4. Select Tax code “SV-8” and Edit

Tick Checkbox “Default“

Method 3 :

If you are not using above method for Default Tax code , Probably you are setting default Tax code by Account Code / Debtor Code or Item

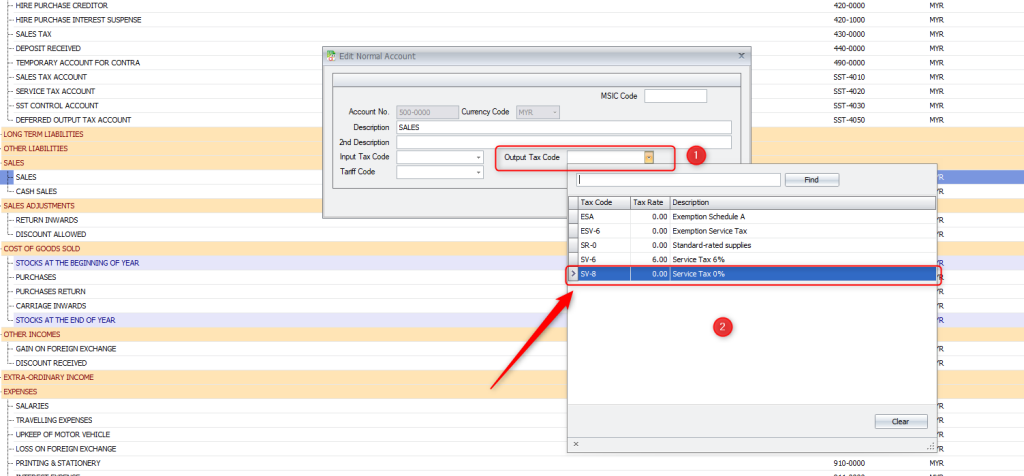

1. If you are using Default tax code by Account code

Go To G/L > Account Maintenance

Edit Account and Set Output Tax code to 8% Service Tax

2. If you are using Default Tax Code by Debtor Code

Go To A/R > Debtor Maintenance

Edit Debtor > Other > Tax Code

Set Tax code to 8% Service Tax

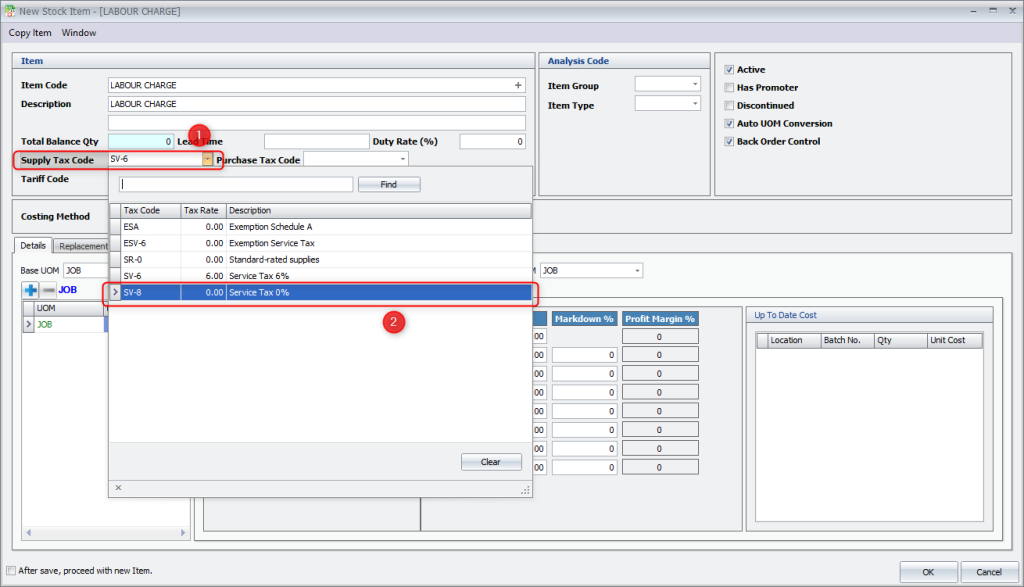

3. If you are using Default Tax Code by Item Code

Go To Stock > Stock Item Maintenance

Edit Item > Supply Tax Code

Set Supply Tax code to 8 % Service Tax