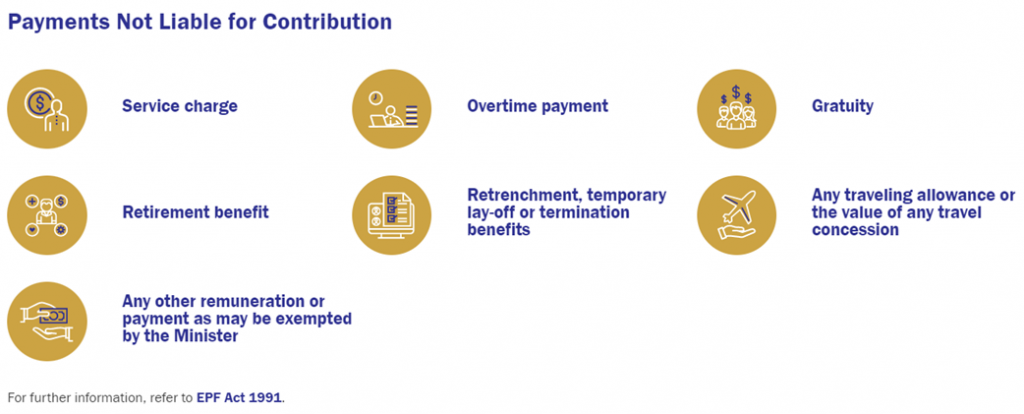

Payments Liable / Not Liable for EPF, SOCSO Contribution

https://www.kwsp.gov.my/employer/what-you-need-to-know#Wages

Dated: 10/10/2021

The above list is not exhaustive. Should require further clarification, please contact EPF Contact Management Centre at 03-89226000, enquiry or any EPF Office.

•Definition Of Wages: •Any remuneration payable in money to an employee is taken as wages for purposes of SOCSO contributions.

This includes the following payments:

i. Salary

ii. Overtime payments

iii. Commission and service charge

iv. Payments for leave; such as annual, sick, maternity, rest day, public holidays and etc

v. Allowances such as incentives, shift, food / meal, cost of living, housing and etc

•All payments made to an employee paid at an hourly rate, daily rate, weekly rate, piece or task rate is considered as wages.

However the following payments are not considered as wages:

i. Payments by an employer to any statutory fund for employees

ii. Mileage claims

iii. Gratuity payments or payments for dismissal or retrenchments

iv. Annual bonus

https://www.perkeso.gov.my/en/our-services/employer-employee/registration.html

Dated: 10/10/2021

The above list is not exhaustive. Should require further clarification, please contact SOCSO Customer Service at 1-300-22-800, enquiry or any SOCSO Office.